(PONARS Eurasia Policy Memo) These days there is much ado about the international security consequences of the slumping U.S. nuclear industry. With cheaper natural gas and the declining cost of renewables, the industry faces strong headwinds just as Russia’s commercial nuclear sector is emerging as a dominant global player by offering concessionary state-backed integrated deals that are large, inexpensive, and long-lived. While there is debate on how Russia may use this power shift in the global nuclear industry to increase its geostrategic influence, there is near consensus among Western experts that it opens the door for Moscow to spread lax nuclear security and nonproliferation standards. As summed up by a senior State Department official, the current predicament constitutes a “vicious circle” between eroding U.S. commercial competitiveness, rising Russian influence over nuclear energy states, and faltering global nuclear security and nonproliferation norms. This challenge is conspicuous in the Middle East, where Washington’s insistence that Saudi Arabia and other regional nuclear aspirants accept stringent restrictions on their nuclear fuel cycle capabilities has stalled commercial nuclear deal-making by U.S. companies. This Washington–Riyadh impasse creates mercantilist opportunities for Russia—and increasingly China—to win over new customers by offering deals with fewer nonproliferation strings attached.

But do Russian commercial nuclear deals necessarily undermine global nuclear security and nonproliferation, as well as U.S. leadership on these issues? A systematic comparison of U.S. and Russian bilateral nuclear cooperation framework agreements since 1990 paints a more complicated but progressive picture. Specifically, Russia has been increasingly aggressive since 2010 at boosting both the quantity and quality of its long-term framework agreements that complement upward trends in its foreign reactor business. Although important differences in bilateral practices persist and the U.S. nuclear industry faces stiff, if not unfair, competition from state-backed Russian players in emerging markets, the externalities for international nuclear security and nonproliferation create critical strategic complementarities.

Where Is the Link?

The direct link between America’s commercial nuclear competitiveness and the potency of the international nonproliferation regime seems self-evident and compelling. This premise has emboldened successive administrations to leverage U.S. strength in the nuclear market to induce individual states’ acceptance of strict controls on the transfer and use of American nuclear technology. Such sweeping claims, however, rest on tenuous analytical foundations.

First, any connections between the market power of the U.S. nuclear industry and global nonproliferation standards are difficult to disentangle from other factors. Early on, this positive association seemed to be embedded during the period of rapid growth in the size and power of the U.S. commercial nuclear industry. However, the industry’s growth was buoyed by America’s superpower status and by the spread of U.S. nuclear knowledge and technology under Washington’s ‘Atoms for Peace’ program. This obfuscates the significance of market power alone as an influence on the strength of the international nonproliferation regime. Even with the expansion of new suppliers and trough of demand for global nuclear commerce in the 1980s, American companies remained prominent across the global nuclear industry, while Washington spearheaded efforts at tightening the nonproliferation regime to avert a horizontal nuclear weapons cascade. With the recent steep downturn in foreign reactor new builds by American vendors and Russia’s emerging dominance of over 60 percent of international construction and operation markets, the United States nonetheless persists as the trusted leader in providing nuclear safety, security, capacity building, and nonproliferation services—and consistently upholds the highest nonproliferation standards in its umbrella agreements.

Second, the scholarship on supply-side nuclear proliferation pathways generally ignores the impact of shifts in nuclear markets on the quality of restrictions imposed by rival suppliers versus the strategic behavior of customers. Contemporary statistical studies typically conflate bilateral state-to-state nuclear agreements with commercial transactions. Consequently, they either dilute or altogether neglect assessment of the main bilateral instruments used by governments to convey explicitly nonproliferation and administrative commitments that are legally binding on subsequent transactions between state and private entities of respective nuclear industries.

Finally, references to Moscow’s nonproliferation restrictions on nuclear trade are ad hoc, based on a narrow set of cases and inferred from Russia’s predatory commercial behavior, rather than derived from analysis of the formal commitments extended via nuclear cooperation agreements. This stylized characterization of Russia’s nuclear cooperation agreements overlooks ongoing debate within Russia over balancing the state’s security priorities with the competitiveness of its nuclear industry, and it is untethered from a comprehensive assessment of changes that Russia has made since the Soviet collapse to nuclear cooperation policies and standard terms of supply. The latter omission is especially glaring—notwithstanding potential problems created by state corporation Rosatom’s mandate to both promote and regulate foreign reactor sales since 2007—considering that Russia is one of the few supplier states besides the United States that requires by law that a general inter-governmental cooperation framework agreement be in place before national entities can agree to any joint nuclear energy project.

Quality Amid Quantity

Rather than coasting on the Soviet legacy of tight nuclear controls and nonproliferation, Moscow has advanced 58 bilateral umbrella agreements since 1990 (compared to 44 for the United States). Nearly 50 percent of these framework agreements have been signed since 2010, with 40 percent of the total coming into force since the adoption of Rosatom’s aggressive, export-focused “Strategy 2030.”

Of course, there is more to demonstrating national commitments to nonproliferation in nuclear trading than simply signing and bringing into force bilateral framework agreements. Critics of Russia’s intentions claim that its rapidly growing portfolio of nuclear cooperation framework agreements is due to Moscow’s willingness to accept weak restrictions as a gesture to gain competitive advantage for the Russian nuclear industry, as an instrument for revanchism, or as a means to constrict American commercial and diplomatic power. Yet, this broad characterization does not capture the significant variation in nonproliferation restrictions embedded in the texts of contemporary bilateral nuclear cooperation framework agreements, as well as the general tightening of these restrictions over time.

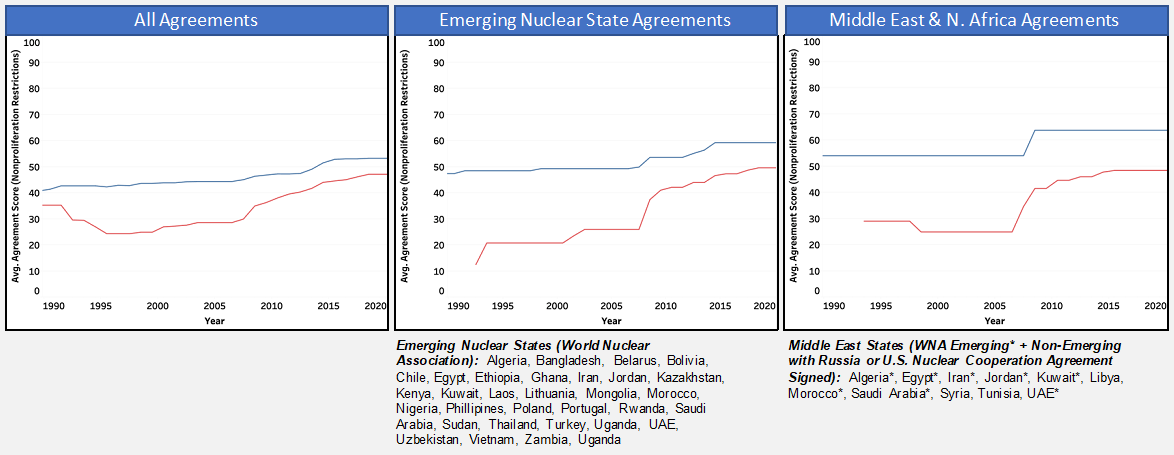

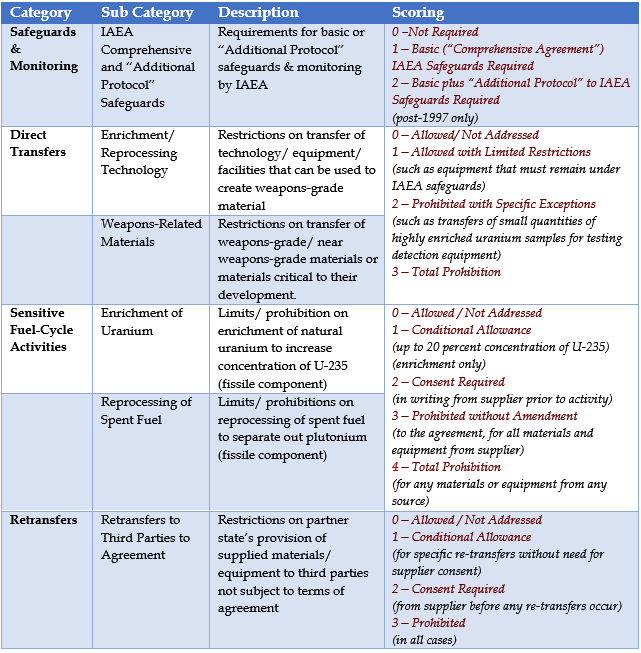

This variation can be seen in Figure 1, which depicts a systematic comparison of the qualitative nonproliferation restrictions embodied in 102 nuclear bilateral framework agreements in force or signed by the United States and Russia since the end of the Cold War, based on criteria summarized in the Appendix. This comparison illuminates two fundamental dimensions of convergence across four key areas of nonproliferation restriction—adherence to IAEA safeguards requirements, direct transfers of sensitive and weapons-related technology, sensitive fuel cycle activities, and re-transfers to third parties.

Figure 1. Comparison of Portfolio Scores for Russian and U.S. Agreements in Force with All, Emerging, and Middle East Nuclear Customers

The first dimension is the convergence in the average aggregate restrictions across the universe of active Russian and U.S. agreements. On the one hand, the United States stands out with variable but consistently tight restrictions across all four areas, punctuated by unmatched “gold standards” with complete prohibitions on indigenous enrichment and reprocessing in the cases of Taiwan and the UAE. Conversely, Russia’s aggregate portfolio is diffuse, with nearly 25 percent of the agreements scoring in the bottom third, 20 percent in the top third, and roughly 50 percent in the middle—revealing Moscow’s willingness to accept both lower and a broader range of nonproliferation restrictions from its partners. On the other hand, as captured by the first graph, Moscow has dramatically tightened the portfolio in terms of numbers of agreements and quality of restrictions since 2010, the period of greatest state foreign export activism. This trend is consistent across all sensitive areas. In fact, Moscow has recently exceeded U.S. practice on direct transfers, inserting both spent-fuel take back arrangements and a default blanket prohibition on the delivery of dual-use or weapons-related technologies absent formal amendments.

Second, as highlighted in the second and third graphs, this general pattern of improvement in the strength of Russian restrictions extends to groups of countries that may be at higher risk of proliferation, such as nuclear energy aspirant states (second graph), and Mideast states (third graph). While gaps between U.S. and Russian agreements are a bit wider, the overall quality of agreements is higher in both contexts than the improving average across all agreements signed by Moscow since 2010. Moreover, the U.S. profile is defined by the single “gold standard” agreement with UAE, whereas Russia’s qualitative improvements are reflected across agreements in force with Jordan, UAE, Kuwait, and Saudi Arabia. This underscores that recent head-to-head commercial competition in emerging markets is far from a systematic “race to the bottom” in terms of the quality of nonproliferation restrictions extended by either Washington or Moscow.

The Middle East Microcosm

Concerns about Russia’s lax nonproliferation trading standards are especially elevated in the Middle East, where the prospects for nuclear energy are seen to be favorable owing to high projected population growth, rapid industrial diversification, increasing need for water desalination, and the desire of petro-states to reduce domestic consumption of hydrocarbons in order to boost shares in lower-priced export markets. Here, Saudi Arabia is the prize, with plans for constructing 16 commercial reactors by 2030, but the United States nuclear industry may be locked out of this market. Preoccupied with keeping fuel cycle options open in order to add value to potential uranium reserves and as a hedge against a future nuclear-armed Iran, Riyadh has consistently rebuffed Washington’s “gold standard” restrictions. It has further intimated that Washington’s terms may deprive American vendors of a “seat at the table,” effectively enhancing the appeal of Russian and Chinese state-backed vendors for the Saudi contracts. Moscow is poised to exploit this opening, fueled by Rosatom’s aggressive campaign to ink new reactor deals on concessionary financial terms with U.S. regional allies— e.g., Turkey and Egypt—and by the expanding strategic relationship that Moscow has forged with Riyadh since 2016.

Yet, the picture is more muddled than conventionally depicted. Notwithstanding Rosatom’s pre-pandemic push for landing 19 new reactor deals across 14 countries, Russian nuclear construction has suffered delays and cost overruns, and Russian government finances are strained by international sanctions, low natural gas prices, and onerous financial obligations from Moscow’s agreement to fund most costs for the nuclear reactor projects in Turkey and Egypt. The Spring 2020 oil price war with Riyadh also demonstrated the limits of strategic convergence, and when coupled with the knock-on costs from COVID-19, both Moscow and Riyadh are ill-positioned to take on new commitments for building large-scale reactors for the foreseeable future.

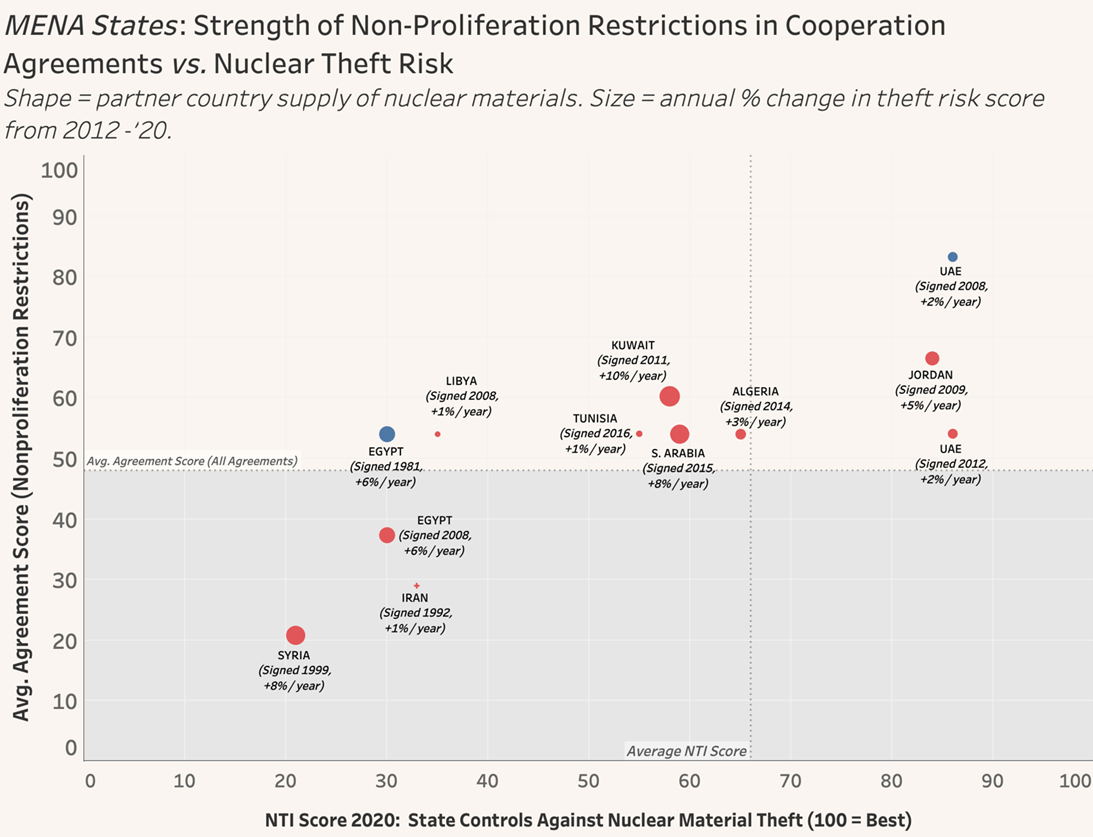

Figure 2. Agreement Restrictions and State Nuclear Theft Risks in the Middle East

Should the nuclear business climate improve in the Middle East, there is still room for optimism that heated U.S.-Russian commercial competition will not unleash proliferation risks. As Figure 2 illustrates, Russia has five times as many agreements in force in the Middle East as does the United States, including with states such as Kuwait, Jordan, and Saudi Arabia. The latter present diverse challenges to nuclear security and have evaded signing contemporary “123 Agreements” with the United States. On the one hand, this raises real concerns as some of Moscow’s weakest agreements are with Egypt, Iran, and Syria, states that have notoriously lax nuclear security and export controls. On the other hand, these agreements are less reflective of the post-2010 pattern, where Russia’s commercial nuclear activism associated with Kuwait, Saudi Arabia, and Jordan both coincide with higher quality framework agreements and correlate with five percent or greater improvement in the capacity of the respective customer to combat nuclear theft (the same improvement seen with Syria and Egypt). Although it is premature to attribute these modest improvements in nuclear theft risk to the terms within Russia’s nuclear cooperation agreements, Moscow’s nonproliferation commitments help to fill gaps resulting from the absence of U.S. “123 agreements,” especially in cases such as Kuwait that present significant challenges on both the nuclear security and transshipment fronts.

Implications for U.S.-Russian Cooperation

While causal links have not been established, preliminary empirical trends are clear: the gap in “quality” of restrictions embedded in U.S. and Russian agreements has significantly narrowed since 2010, especially in contested and risky emerging markets like the Middle East. Although important differences persist, the challenges are both more nuanced and suggestive of new policy directions for strengthening nonproliferation.

As commercial focus and restrictions embedded in U.S. and Russian bilateral nuclear agreements tend to be more complementary than subversive, there is space for greater coordination to tighten rules of the road for nuclear security and nonproliferation across the nuclear industry. With a focus on the risks presented by specific customers, both states can benefit more from the other’s efforts at targeting enhanced restrictions on key states, such as Egypt and Syria, than from distorting the security issues associated with the pursuit of “gold standards.” Because the Russian and U.S. nuclear industries focus on different customers, both states stand to gain from encouraging the other’s steady improvement of restrictions. For the United States, this is especially the case in Russia’s dealings with nuclear aspirant states—such as Rwanda, Sudan, and Libya—that are unattractive to the U.S. industry but still present serious risks of nuclear theft, trafficking, and transshipment.

That said, real prospects for cooperation may rest with leveraging convergence on key restrictions, such as safeguards. Both states are primed to apply joint pressure for customer states to accept the Additional Protocol as a universal condition for bilateral nuclear trading. Given Moscow and Washington’s shared international nuclear security interests, similar commercial statures, and complimentary best practices, the two states could give their imprimatur to higher standards for competitive nuclear commerce among rival suppliers. The opacity surrounding China’s recent uranium milling and fuel cycle transactions with Saudi Arabia, coupled with general uncertainty regarding the “quality” of Beijing’s nuclear security and nonproliferation restrictions, underscores the mutually detrimental outcomes that can occur when customers can exploit daylight between suppliers, as well as the threat this presents to the strong nuclear security and nonproliferation norms that Washington and Moscow have spearheaded for decades.

While the moment may not be politically ripe for realizing these prospects, the time has come to jettison tired tropes that contrast uniformly high U.S. standards for nuclear security against uniform Russian laxity, given the variability of restrictions in U.S. “123 agreements” and the steady improvements in nonproliferation commitments embedded in Moscow’s bilateral cooperation agreements. This canard obfuscates reality, unnecessarily constrains the U.S. nuclear industry, and fuels acrimony with Moscow to the detriment of realizing mutual interests in nonproliferation and nuclear security. It also risks tarnishing nuclear energy among an American public whose support seems adversely affected by the association of nuclear power with nuclear weapons and security threats. For these reasons alone, it is imperative that U.S. policymakers and nuclear industry leaders engage Russia in a more forthright manner as a strategic “frenemy”– an ally for upgrading nonproliferation norms and also a fierce competitor in the rough and tumble commercial nuclear export markets.

APPENDIX

Scoring Criteria for Nonproliferation Restrictions Embedded in Russian and U.S. Nuclear Cooperation Agreements

To support our analysis of the nonproliferation restrictions embedded in the Russian Federation and United States bilateral frameworks for nuclear cooperation, we developed a dataset of 102 such agreements that were either:

a) in force for one or more years between 1990–2020, or

b) signed during this time period but not yet entered into force.

In order to compare the nonproliferation restrictions embedded in the texts of bilateral framework agreements for peaceful nuclear cooperation, we reviewed a sample of Russian and U.S. agreements and identified areas that contained restrictions on the activities and behaviors that could support a partner country’s progress towards developing a nuclear weapon if the partner chose to proliferate, or activities and behaviors that could lead to the theft or other diversion of nuclear material, knowledge, technology or equipment by unauthorized persons, as conveyed in the table below.

Adam N. Stulberg is Sam Nunn Professor and Chair, and Jonathan Darsey is PhD Candidate, in the Sam Nunn School of International Affairs at the Georgia Institute of Technology.

The authors are grateful for the data analytical support provided by Murry Smith and Taylor Poole, as well as the financial support provided by the Scaife Foundation, Carnegie Corporation of New York, and the Office of Naval Research.

[PDF]