(PONARS Policy Memo) The conventional wisdom about agriculture reforms in post-Soviet countries is that they failed to achieve their stated objectives. This assessment is largely based on studies that focused on the initial decade of agricultural reforms that was indeed marked by output collapse, land abandonment, and rural outmigration. Many observers continued to emphasize failures well into the 2000s, blaming them on the flawed institutional design of rural reforms under President Vladimir Putin. Such assessments rightly point to very serious challenges in post-Soviet agrarian sectors, but they also obscure important changes that have occurred in rural economies in some parts of the post-Soviet region over the last fifteen years. A number of agricultural producers have updated production methods, seen significant growth, and become integrated into global markets. Though rural communities in many regions continue to struggle, some sub-sectors and fertile regions have attracted significant domestic and foreign investment and have been the site of important rural transformations.

This memo draws attention to trends in the agricultural sector in Russia, Ukraine, Belarus, and Armenia, where, in some regions, investment, productivity, overall production levels, and exports have all increased significantly over the last fifteen years—for example in Russian wheat, Ukrainian corn, Belarusian dairy, and Armenian fruit. What is interesting about these trends is that global integration and technological change has happened despite highly varied and what appear to be weak institutional frameworks. Growth and productivity gains resulted not from a general improvement of institutional parameters across these economies, but from selective reforms and policies aimed at attracting foreign investment and generous state support in sectors deemed to have comparative advantages. These transformations are in large part the result of deliberate growth strategies and targeted subsidies to particular sub-sectors. These helped carve out long time horizons for well-capitalized farms that are deemed capable of realizing the political goals these governments seek to realize in agriculture.

Investment Trends, Productivity Gains, and Growing Export Capacity

After the collapse of the Soviet Union, CIS countries pursued varying rural reform strategies with different degrees of land privatization and land sales. Land reform laws were implemented in the early 1990s in all four countries examined here. In Russia, Ukraine, and Armenia, agricultural land held by state farms (kolkhozes and sovkhozes) was privatized but land reforms were partly stymied by political actors who opposed liberalization and were reluctant to cede state control of land assets. In these three countries, rural sectors struggled with the partial market reforms that resulted, in part, from these political compromises. While rural producers were confronted with disruptions to supply chains and foreign competition, they had very little access to capital and other resources to deal with the tremendous challenges that the transitions entailed. Output collapse and rural outmigration were the result. In Belarus, the vast majority of agricultural production remained firmly in control of state-owned collective farms, and private actors were only allowed to own small parcels of land.

The 1990s brought limited de facto change in ownership and production methods across the post-Soviet region: collective farms remained the largest landowners and they did not dramatically change how they farmed the land. In some regions, the situation changed gradually around the turn of the millennium and more swiftly in the mid-2000s. As global food commodity prices started to rise, domestic and foreign investors became increasingly interested in arable land in post-Soviet countries, recognizing its value as both a speculative and productive asset. More private and public capital flowed to the countryside and agricultural production recovered.

Russian agriculture saw a significant influx of capital in the 2000s as domestic and foreign investors recognized the value of Russia’s most fertile arable land. Fixed capital investment increased more than tenfold between 2000 and 2015 and foreign direct investment in agriculture more than quadrupled in the decade between 2004 and 2013. During this time, and largely due to this capital influx, a new type of property owner emerged: new agricultural operators (NAOs). These were vertically integrated agricultural producers who accumulated large swathes of land in Russia’s most fertile regions through land purchases and long-term leases from former collective farms.

Many Russian NAOs are funded and linked to Russia’s oligarchic conglomerates, though not all—others have remarkably global financial backers, including from the United States, Europe, Gulf countries, and China. Because of capital investments, NAOs operate with cutting-edge farm equipment and technology, which allows for more efficient production and increasing productivity. In Russia’s southern regions, for example, wheat production and yields increased significantly. These trends contributed to a remarkable reversal of the country’s grain trade balance. Russia had been dependent on imported grain since the 1970s; by 2010, it had become a major exporter of grain and in 2016 it became the world’s largest wheat exporter. The country went from importing 20.9 million metric tons annually on average at the end of the Soviet period to exporting 14.1 million metric tons annually roughly twenty years later.

Much like Russian agricultural producers, Ukrainian agriculture experienced an unexpected boom over the last decade. In corn and soybeans in particular, production and productivity soared. These trends were largely driven by the adoption of and investment in hybrid seeds and biotechnologies. While overall FDI inflows to Ukraine in general have remained relatively low, foreign investment in agriculture increased significantly over the last decade. By 2015, Ukraine was among the top 10 countries with the largest shares of agricultural inflows among their total FDI inflows. Like Russia’s capital inflows, the source of investments has been global in nature, coming from American and European “agribusiness giants” as well as from new firms in China and Gulf countries.

Much of this investment has been directed toward the infrastructure of Ukrainian agriculture, biotechnology, and seed, corn, and soybean production companies. The influx of hybrid and genetically modified seeds is remarkable in light of the fact that Ukraine does not formally allow the use of GMOs. The legal framework on GMO is circumvented because of a clause in the 2014 EU–Ukrainian Association Agreement that accepts cooperation in the sphere of biotechnologies. This loophole opened the door for Western seed and agricultural input giants, such as Monsanto, DuPont, and Cargill. The year 2013 marked the biggest corn harvest in Ukrainian history and a stunning 486 percent increase in productivity since 2008. In 2015, an estimated 80 percent of Ukrainian soybeans were grown from GM seed and, not surprisingly, 2016 saw a record harvest of soybeans. Corn and soy booms also drove a sharp rise in Ukrainian agricultural exports: agriculture increased from 12 percent of Ukraine’s total exports in 2005 to 27 percent of total exports in 2013.

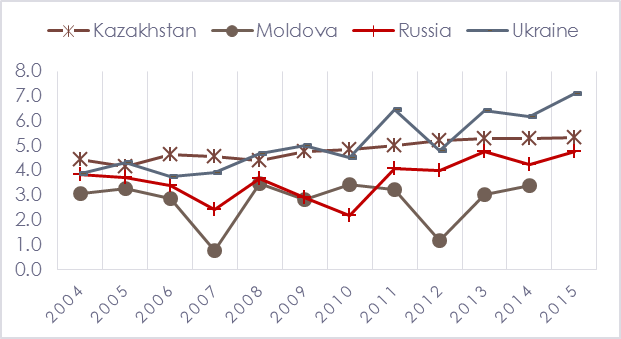

Figure 1: Corn yields in four major CIS corn producers, 2004 – 2015 (tons/hectar)

Source: AgriCIS trade

Though Armenia’s economy has been growing for much of the 2000s, agriculture initially lagged behind as challenges from the 1990s continued. Since 2010, agriculture has recovered and received a sizable share of the country’s foreign direct investment (FDI). While total FDI to Armenia fell overall after 2008, FDI to the agricultural sector has increased since the global financial crisis. The most significant investments are in wine and grapes, and other high-value production such as fruits (including organic fruits), berries, and walnuts. Improved technology, access to capital and the investment in processing facilities have contributed to the increased diversification of Armenian agriculture and growth in output and exports. Fruit and vegetable production increased by over 30 percent between 2006 and 2015. Agriculture’s share of GDP and of exports increased throughout this period, with apricots representing the largest fruit export in volume and nearly 50 percent of export revenues.

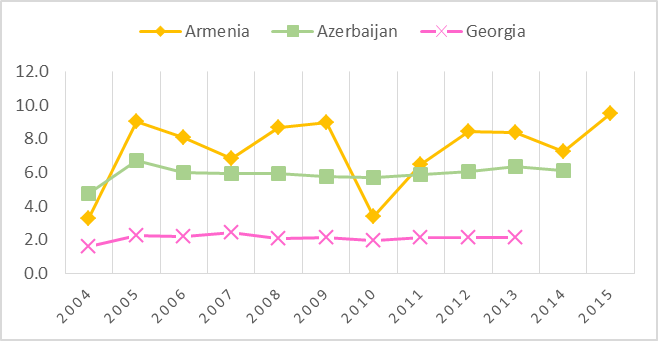

Figures 2: Fruit yields in the South Caucasus, 2004 – 2015 (tons/ha)

Source: AgriCIS trade

Perhaps the least well-known agricultural trend in CIS agriculture is the significant growth of the Belarusian dairy industry. Dairy is by far Belarus’ most important export commodity, accounting for 48 percent of total exports in 2010. Growth in the dairy industry started in the early 2000s and has accelerated in recent years, largely because of Russia’s ban on food imports from the United States and Europe, which fueled Russian demand for Belarusian dairy. Much of this production boom and export success was made possible by the construction of new dairy farms and processing facilities, technological upgrades of thousands of existing facilities, increases in herd size per farm, and training of the labor force in the sector. Belarus also invested heavily in facilities producing dry dairy products, making the country the third biggest exporter of dry whey in the world.

Unlike Russia’s privately owned NAOs, the majority of the farmland and all large-scale dairy producers in Belarus are state-owned. Much of the modernization of Belarusian dairy is financed by public funds: the government has allocated more than $40 billion to modernize the agriculture sector in the last few years. In addition to public domestic funds, a few large Russian milk producers have invested in the Belarusian dairy sector, most notably “Yunimilk,” a Russian milk-processing giant owned partially by Danone. Unlike Ukrainian companies involved in the corn and soy boom, Belarusian dairies were, in general, not recipients of significant foreign investment. Capital inflows to Belarus are generally low and agriculture only accounted for about 1.7 percent of FDI in 2013.

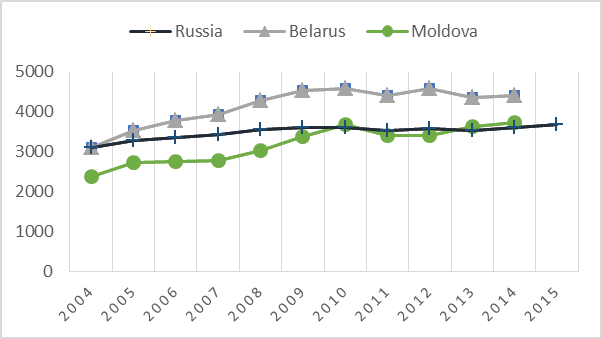

Figures 3: Milk yields in RU, BE and MO, 2004 – 2015 (kg/cow)

Source: AgriCIS trade

Institutional Setting

Existing studies on the effects of capital inflows often focus on domestic institutional parameters as the decisive variable to explain local developmental outcomes. “Weak” institutions, including the uneven application of laws and regulations, unclear assignment of responsibility to relevant institutions, abuses of public powers for private gain, and lack of transparency and information to identify and utilize economic opportunities, are all thought detrimental to development because they deter investments with long time horizons. This approach, often referred to as “good governance,” though still widely held, has become increasingly questioned as a theoretical concept and as a development agenda.

This skepticism is confirmed by data on institutional conditions in post-Soviet countries—the four countries assessed here have a varied, and, at best, mixed track record of institutional reforms. Belarus, for one, retains nearly complete state control of the dairy sector. One of the many implications of this ownership structure is that the state fully regulates prices in the sector. The absence of market-oriented restructuring of large farm enterprises has largely prevented private investment in agriculture. Russia and Ukraine undertook some reforms during the early and mid-2000s to facilitate investment in agriculture, but few observers would argue that the institutions in all four countries, overall, fulfill the criteria that the good governance canon holds as essential characteristics of a strong institutional framework.

In Russia, many observers note that despite land reforms, land registration is cumbersome, costly, and time-consuming, and that there is generally little transparency and awareness of legal processes. Others point to weak administrative capacity, endemic corruption, and the fact that many aspects of the regulatory framework are hopelessly outdated. The security of property rights remains unsettled, corruption is widespread, a significant degree of political risk is associated with foreign investments, and transparent and participatory governance declined precisely in the decade when agricultural productivity increased.

The Ukrainian government also pushed forward several reforms and laws in the 2000s, but international observers continue to point to shortcomings in the country’s institutional setting. Specifically in agriculture, it bears noting that the import and use of hybrid/GM corn and soy are largely legal grey areas: they are technically illegal, but widely practiced and laws are not enforced. The moratorium on sales of private agricultural land remains in place and makes it impossible for a) citizens to exchange land freely and b) foreign actors to invest in land without reliance on local partners.

Much like Russia and Ukraine, Armenia has generally welcomed foreign investment, adopting an “open door” policy and introducing Free Economic Zones that offer tax benefits and tariff breaks. Armenian institutions have generally been rated much higher than Ukraine’s, for example, but Armenia’s economy still faces challenges concerning contract enforcement, resolving insolvency, construction permits, electricity provision, and tax payments. Similarly, although Armenia’s corruption indicators are relatively good for the post-Soviet region, investors still complain about the detrimental effect of corrupt practices on the business environment.

State Support for Agriculture

Instead of a generally improved institutional framework that uniformly created favorable conditions for all actors, what seems to have made rural transformations in these countries possible was targeted state assistance and sustained political attention.

The Russian government has been supporting agriculture since the early 2000s with a cornucopia of measures aimed at increasing domestic production and reducing export dependence. As oil prices rose and tax collection improved by the mid-2000s, state support for domestic agriculture strengthened. Between 2005 and 2010, total state support to agriculture more than tripled in nominal rubles, rising by 135 percent in real rubles. These measures changed over the years, but included trade restrictions, a variety of subsidized long-term and operational credits, tax breaks, local content rules, and the creation of a state-owned grain trader that purchased grain at favorable prices. The Russian government also invested in physical infrastructure to facilitate the modernization of agriculture (e.g., grain elevators, port facilities, roads, and utilities for new processing facilities).

State support for agriculture in Ukraine has also been relatively high: with producer support around 1.62 percent of GDP, it provides state support well above the OECD average (.34 percent of GDP) and other emerging economies. State support is allocated primarily through agricultural tax benefits and favorable trade policies. Ukraine’s agricultural tax policy is focused on “sub-sector strategies” rather than universal policies: field crops are one of the primary sub-sectors receiving tax benefits and public support. Despite laws that formally disallow foreign investors from purchasing land, the Ukrainian government has worked actively with foreign firms to acquire biotechnology and seed companies that provide critical inputs.

The Belarusian government has long recognized the importance of the country’s dairy sectors and heavily supports producers and processors in the sector, allocating significant budget funds to modernize dairy farms and to building new processing facilities. The Armenian government’s agricultural support focuses on subsidizing input costs and improving access to credit for small farmers through credit subsidies. Moreover, in order to address the issue of land utilization, the government has offered direct payments to farmers based on acreage under cultivation. It has also used trade policy to support agricultural exports and production: tariffs are in place for imported agricultural products, while raw materials for agri-food processing and agricultural exports are exempted from tariffs and taxes.

Conclusion

Across the region, very targeted and at times generous support measures and policy interventions—trade restrictions, subsidized credits, tax breaks, local content rules, purposely created state-owned enterprises—have helped actors in certain sub-sectors. Promising to realize the goal of increasing domestic production, these actors have thrived under what could be called “umbrellas” that protect property rights and provide investment on a long time horizon, despite uneven institutional context overall.

Susanne Wengle is Assistant Professor in the Department of Political Science at the University of Notre Dame and concurrent faculty in the Keough School of Global Affairs.

[PDF]