The specter of currency wars is again haunting policymakers. An outburst of competitive devaluations of national currencies happened on a major scale during the Great Depression. In recent decades, there has been a rapid accumulation of reserves by developing countries, especially China. This is reviving the threat of a surge of exchange rate protectionism.

The ratio of foreign exchange reserves (FOREX) to GDP in China and Russia has dramatically increased, and there are countries (like Botswana, Hong Kong, Malaysia, and Singapore) with even higher ratios of reserves to GDP. In fact, most developing countries have been accumulating reserves rapidly over the last 10 to 20 years, so the global ratio of FOREX-to-GDP and FOREX-to-import has more than doubled. But in Russia and China this ratio has increased five times in the last decade. Why have so many developing countries, including China and Russia, suddenly begun to build up their reserves?

This memo argues that reserve accumulation is an industrial policy that favors profits, savings, investment, exports, the tradable goods sector, and growth at the expense of wages, non-tradables, consumption, and imports. Sometimes called exchange rate protectionism, it became especially popular after rounds of trade liberalization negotiations within the GATT-WTO system de facto “outlawed” conventional tariff and non-tariff protectionism.

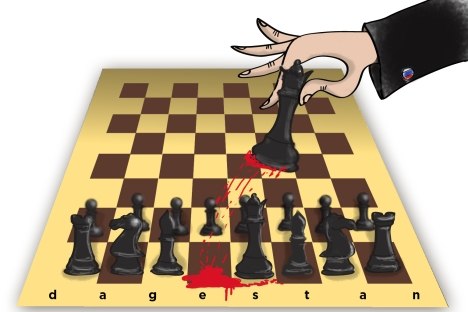

Currency Wars: Why Russia and China are Rapidly Accumulating Foreign Exchange Reserves

PONARS Eurasia Policy Memo No. 256

by Vladimir Popov

June 2013