(PONARS Eurasia Policy Memo) The use of sanctions to push Russia to change its foreign policy behavior has come under heated debate. Proponents argue that the sanctions policy pursued by the West has imposed sizeable costs on the Russian economy. Critics counter that Russia may not have incurred sufficient pain to pull back from its foreign policy adventurism. Broad macroeconomic overviews claim that sanctions have worsened the investment climate and inflicted significant damage on Russia’s long-term growth potential. But given their concurrence with the collapse of oil prices in late 2014, many believe the sanctions’ contribution to Russia’s current economic malaise is at best partial. This memo uses UN Comtrade data to investigate one understudied area where the sanctions could be expected to hit home: Russia’s export relationships with the rest of the world.

The analysis uncovers two broad findings. First, although Russia’s export volumes as measured in U.S. dollars have fallen dramatically since 2014, Russia’s currency depreciation has blunted some of that impact on revenue in ruble terms. Sanctions have helped decouple the ruble and oil prices. As a result, buoyant ruble receipts have helped the Russian government run a budget surplus in 2018 for the first time since 2011, reducing its need for state borrowing and partly freeing it to ramp up domestic spending. Second, international sanctions have generated heightened political risk around dealing with Russia, mainly among the countries in the West that actually levied sanctions on Russia. Elsewhere in the world, Russia has been able to maintain, if not improve, its trading relationships. This may deprive the United States and EU of some of their leverage over the Kremlin’s ability to generate much needed export revenues. This memo concludes with a broader discussion of how analysts should evaluate the resilience of the Russian economy under the dual blow of sanctions and falling oil prices.

Sanctions and International Trade

Since March 2014, the United States, EU, and a handful of other Western countries have imposed a variety of sanctions in response to Russia’s violation of Ukrainian sovereignty. Whereas certain individuals face asset bans and travel freezes, commercial sanctions prohibit a number of economic transactions with Russian companies. These include providing new short-term debt, sharing dual-use technology that could be used to explore for or produce oil, or conducting any kind of economic activity in Crimea. Many of Russia’s largest firms have been targeted, including Sberbank, Gazprom, Rosneft, and the United Shipbuilding Corporation, with pressure escalating following political events in Ukraine and later suspected interference in the U.S. election. Note that the sanctions initially did not include any export restrictions on Russian companies, instead targeting different inputs these companies depend on to make money, such as finance and technology.

To date, much of our analysis about the effectiveness of these sanctions has focused on two areas. At the macro-level, several scholars attempt to unpack the consequence of sanctions for the Russian economy relative to the simultaneous drop in the oil price. At the micro-level, another set of impressive reports focuses on the financial pain felt by targeted Russian firms as well as the “friendly fire” suffered by Western companies exporting to or investing in Russia. For example, economists from the U.S. State Department have made the strongest academic case that sanctions have lowered the profitability of targeted firms.

Missing so far in this discussion is how the targeted sanctions have affected other Russian companies’ ability to do business abroad. For decades, the Russian government has critically depended on export revenue in the natural resource sector to balance budgets, finance investment, and ensure political and economic stability. One motivation behind the sanctions has been to isolate Russia from international trading and financial communities, and through the subsequent economic pain, force it to rethink its foreign policy. And in the past year, Western countries have begun placing more and more restrictions on Russian exporters. But a key question remains: how have sanctions affected the ability of Russian companies to maintain export relationships with the rest of the world?

First, in generating significant risk, sanctions could threaten to undermine the elaborate networks that Russian companies, even those that were not specifically targeted, have developed to sell their goods and services abroad. As a prodigious exporter of raw materials, Russia is closely integrated into multiple international global value chains. Uncertainty about how far sanctions could swell could compel Western consumers to pivot away from existing Russian suppliers.

In addition, to conduct any business with Russia-related entities, foreign companies must invest heavily in due diligence processes to ensure their activities are not violating sanctions. Yet even armies of compliance professionals cannot completely disentangle the opaque ownership structures in place in the Russian corporate universe. Given a choice about where to source goods and services, Western firms might think twice about choosing a Russian company that could later land them in significant trouble.

On the other hand, sanctions do not completely shut the door on doing business with Russia. Kremlin officials have touted their own pivot to Asia to help compensate for lost profits from the West. A cheap ruble may be giving those efforts a strong push. The Russian Central Bank’s decision to stop propping up the ruble has not only helped the country retain foreign currency reserves, but immediately made Russian exports more competitive on international markets. Even throughout this period of geopolitical tension, Russian firms could conceivably come out ahead.

Sanctions, Financial Crisis, and Ruble Export Revenues

To investigate the effect of sanctions on trading relationships, I turn to sector-level export data collected by UN Comtrade from 2011-2017. The data cover Russia’s export transactions with all countries around the world on an annual basis. I look at how their volume and composition was affected by the imposition of sanctions and fall in oil price. Given rising inflation over the past several years, I deflate all trading sums to reflect real values in 2011 prices.

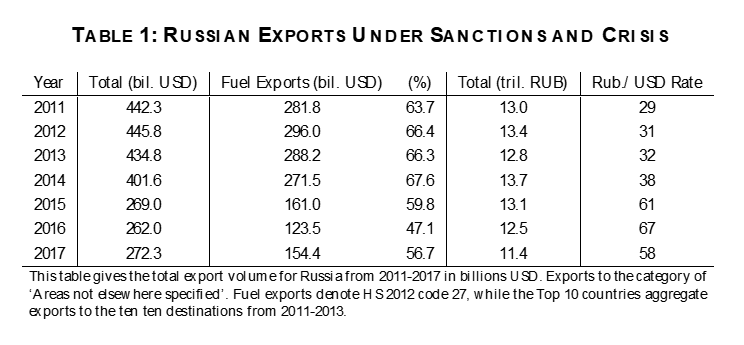

In the period prior to the dual 2014 crises, the data paint a clear picture of a resource-dependent economy heavily reliant on fuel exports to a small number of large countries. Table 1 provides simple descriptive statistics for the period. Over 2011-2013, just under 70 percent of all of Russia’s export revenue came from oil, gas, and their related by-products.[1]

The 2014 crises laid waste to export revenue, at least measured in dollars. From 2014-2015, Russia experienced a one-third drop in overall exports, which more or less persisted up until 2017, the last year for which data are available. Much of this decline is due to a decline in exports of oil and gas (see Fuel Exports, column 3, in Table 1). Relatively speaking, the percentage of exports coming from natural resource exports fell to roughly 54 percent over the period of 2015-2017. Russia has been selling less to the world, and at least for one year, the raw materials on which it had become so reliant in preceding years did not account for the majority of its exports.

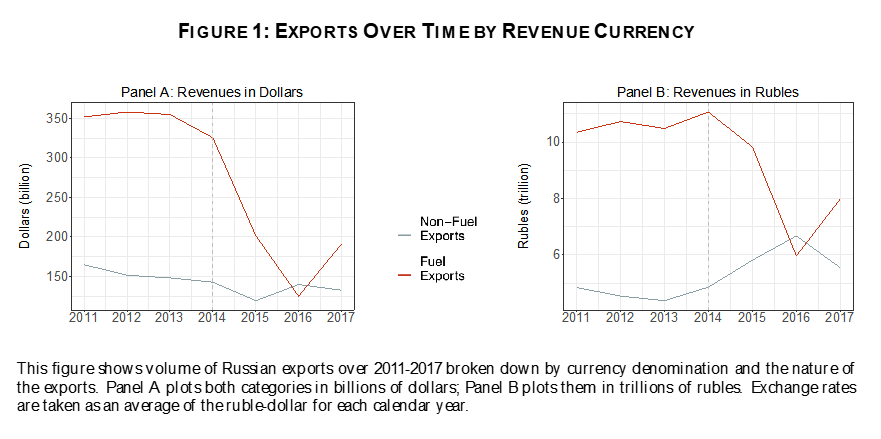

This drop in export revenue is directly connected to Russia’s ruble depreciation. If in 2013 one dollar was worth approximately 32 rubles, by 2016 that number had jumped to 67. By the end of 2014, policymakers in the Kremlin were quite content with letting the ruble float, which was reflected in precipitously declining trade statistics. Figure 1 shows what this actually meant for the Kremlin’s finances. The left panel shows revenue in billions of U.S. dollars broken down by fuel versus non-fuel exports. There is a clear downward shock on the line indicating natural resource dollar revenues in Panel A, the same decline of 40 percent from 2014 onwards shown in Table 1.

But taking a look at the ruble side, we see that the Russian economy only suffered an 11 percent drop in ruble-denominated real export revenue. The decoupling of the ruble from the oil price in 2015 and 2016 meant that Russia could continue to reap huge amounts of revenue in rubles from selling barrels in dollars. What more, non-fuel exports, such as agricultural products, lumber, and metals, increased during this period, as shown by the upwards trend for the blue lines in Panel B of Figure 1. Russian companies operating in sectors outside of natural resources have been increasingly securing new export destinations for their goods and services, helping to dramatically compensate for the overall loss of revenue.

This ruble-denominated buffer is critical for understanding the recent trajectory of Russia’s political economy. Ministry of Finance reports suggest that nearly 40 percent of Russian budget revenues come from foreign trade, and tax changes put in place in 2019 are designed to give the government an even bigger cut. Even under considerable political duress abroad and falling exports, the Kremlin has been able to run a budget surplus due to a slight rebound in oil prices, reductions in expenditures and a focus on exporting different types of goods and services. In early 2018, President Vladimir Putin promised huge outlays on infrastructure, health care and education to stimulate economic growth. International credit markets become less important sources of finance.

Increasing ruble export revenue will not save the Russian economy, especially if inflation remains a thorn in the government’s side. The country is still overdependent on natural resources, and other sectors such as agriculture are only recently becoming competitive on world markets. But the unshackling of the tight correlation of the oil price and the ruble exchange rate offers a silver lining to Russian financial policymakers. Russia Inc. can continue to count on export-generated revenue to partly fund the national pet projects it hopes will alleviate rising poverty levels across the country.

“Buyer Beware” Among Sanctioning Countries

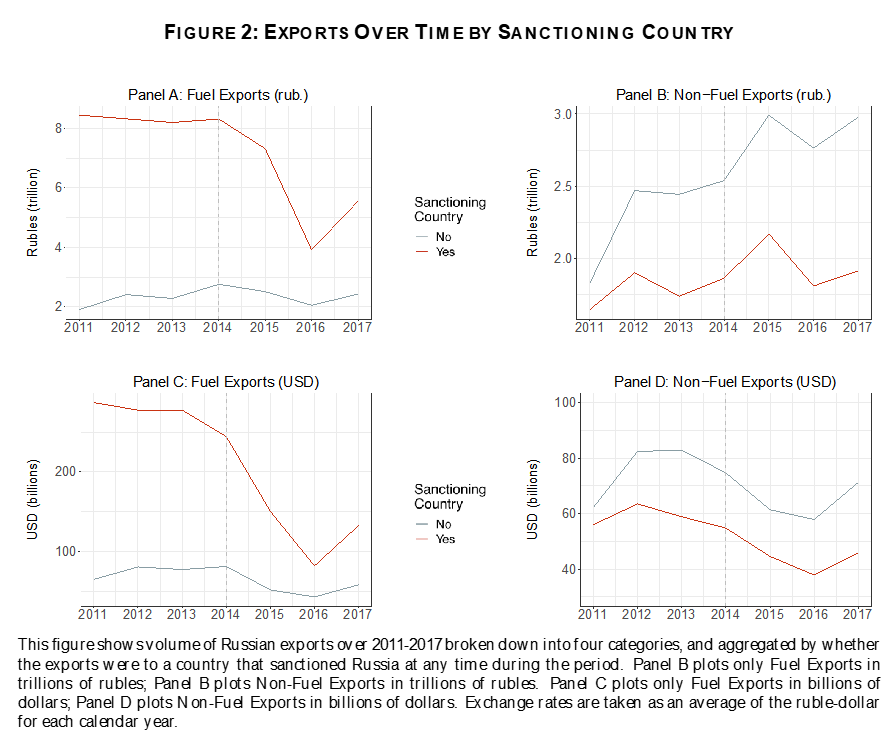

The second key pattern requires unpacking exactly where the drop in Russia’s export revenues come from. I show four plots in Figure 2. The top row shows all export revenue in real rubles, while the bottom row shows the same years in dollars, as calculated using average annual exchange rates. The right column presents revenue from fuel exports, while the left column shows revenue from non-fuel exports (metals, agricultural products, manufactured goods, etc.).

Next, I break out exports according to two categories of countries, as denoted by the colored lines: in red are the 37 “sanctioning countries” that imposed restrictions on Russia beginning in 2014, in blue are the remaining 179 countries that did not participate in the sanctions regime. We might expect that the blowback from sanctions through the political risk channel should inflict the most pain on those countries that imposed them. For example, French or German companies reliant on imports from Russian firms might be most hesitant to maintain such trading relationships going further for fear of a further escalation of the sanctions regime.

Several trends are worth examining in depth. First, in Panels A and C, we see huge declines in the volumes of natural resources among sanctioning countries after 2014. Whereas prior to the crisis the lines were essentially parallel, the sizable drop-off in the money Russian companies earned from selling oil and gas came mainly from sanctioning countries pulling back on their purchases. These countries, located mainly in the West, decreased their consumption of Russian natural resources by roughly 50-60 percent. Non-sanctioning countries continue to import roughly the same volume of fuels compared to their pre-crisis levels. This is partially because of newly on-boarded exports to countries such as China, Singapore, and especially Malaysia, which are importing more Russian oil and gas. In fact, China is now Russia’s leading export destination, accounting for roughly 11 percent of its trade; year-on-year exports to China rose 30 percent last year.

For years, U.S. policymakers have encouraged European countries to wean themselves off Russian fuel exports. As plans materialized to build Nord Stream 2, these recommendations appeared not to be heeded. Although Russia is still the largest supplier of oil and gas to EU countries, it is earning less and less percentage-wise from these relationships as it expands its trading networks eastward. Asian countries in particular are increasing their appetite for Russian oil and gas.

The effects are slightly smaller with regard to non-fuel exports, but still evident (Panels B and D). Sanctioning countries imported fewer products outside of natural resources from Russia after sanctions were imposed, while non-sanctioning countries stepped up their purchases. Whether a country decided to sanction Russia has clear implication for the volume of goods it ultimately imported from Russia in subsequent years.

Broader Implications

What do these patterns uncover about Russia’s place within international trade? For one, analysts need to take into account the unforeseen consequences of a depreciated ruble for Russian political economy. The decoupling of the oil price and ruble exchange rate has produced some significant dividends for the Russian economy, particularly for oil and gas companies. The Russian government is trying to muscle in on these profits, and if successful, may prove more financially resilient than expected. So long as oil prices remain moderately high, the Kremlin will have some flexibility to invest budget revenues into projects geared to shore up its approval ratings and generate a modicum of economic growth. Granted these initiatives are still plagued by corruption risk, but the systemic problems experienced by other nondemocracies around the world seems further around the corner for Russia.

Next, there is suggestive evidence that Russia’s attempts to pivot beyond the West and into new export industries are beginning to bear fruit. By developed country standards, Russia’s economy is still far from diversified. And most of the non-fuel goods on the rise are not high value-added exports or especially technologically sophisticated, such as vegetables and meat projects sold to Egypt, Turkey, and Iran or wood pulp sold to China. But even with additional sanctions causing billions in losses in 2018 (such as in aluminum markets), Russian exports still rose by 25 percent and delivered a large trade surplus. The government’s ability to further cultivate non-Western trading relationships will be an important pattern to watch.

David Szakonyi is Assistant Professor of Political Science at George Washington University.

[PDF]

[1] This statistic is calculated using the Harmonized System 2012 category of “Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.”

Homepage image (credit): Energy Minister Alexander Novak meeting with President Vladimir Putin in January 2019.